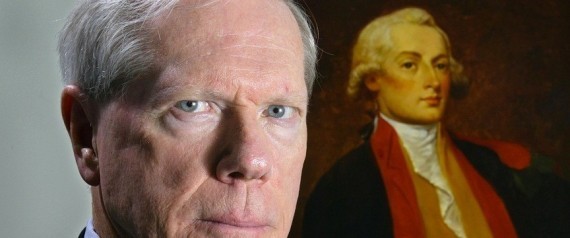

US inflation plummeted to 5% in March, down from 9.1% last summer. Alas, it’s too early to pop open the champagne, as the nation’s economy is tainted by a variety of maladies, as Dr. Paul Craig Roberts, a US economist and ex-assistant secretary of the Treasury in the Reagan administration, told Sputnik’s Dimitri Simes, Jr.

Earlier this week, US Secretary of the Treasury Janet Yellen asserted to the press prior to the World Bank meeting that the US economy is performing exceptionally well, with continued solid job creation, inflation gradually moving down, and robust consumer spending. “I’m not anticipating a downturn in the economy,” the Treasury secretary summed up.

Indeed, the latest employment figures show that nonfarm payrolls grew by 156,000 for March, near the Dow Jones expectations of 238,000; the unemployment rate slid to 3.5% against expectations that it would hold at 3.6%.

At the same time, the consumer price index dropped to 5% on an annual basis last month, down from 6% in February, according to the US Bureau of Labor Statistics.

Bureau of Engraving and Printing Director Leonard Olijar (R) watches as US Treasury Secretary Janet Yellen (C) and Treasurer Marilynn Malerba sign one dollar bills at the Bureau of Engraving and Printing Western Currency Facility on December 8, 2022 in Fort Worth, Texas. –

The US dollar will bear two women’s signatures for the first time, belonging to Treasury Secretary Janet Yellen and Treasurer Lynn Malerba, officials said Thursday as they unveiled the banknotes. – Sputnik International, 1920, 13.04.2023

Does this mean that the US economy is getting back on track? Not so fast, says Dr. Paul Craig Roberts, an American economist and author, who served as assistant secretary of the Treasury in the Reagan administration and associate editor of The Wall Street Journal.

“Well, US Treasury secretaries have to put a positive face on things,” said Dr. Roberts. “I mean, she can’t come out and say we’re about to have a recession. It’s not all that easy to answer the question, because US economic data is so bad. The way they measure unemployment and inflation, for example, are designed to understate both. They don’t count unemployment in a proper way, and they don’t measure inflation in a proper way. There are historical reasons for this. They don’t like to measure inflation properly, because they have to pay out more cost of living adjustments. For example, to Social Security. And a number like high unemployment numbers. So we don’t really know what the numbers tell us. They’re making their optimistic view on the basis of 156,000 new jobs in March, and they claim no further rise in inflation. So they’re thinking in the old Phillips curve way that if you want to grow, you have to pay for it by having higher inflation. And they’re saying, ‘Oh, we’re not having the higher inflation, but we still had 156,000 jobs.’ Well, we don’t know if we did or not.”

There are two ways of measuring jobs: one is the payroll jobs data and the other is the household survey, where they ask individuals. The problem is that the two numbers never match, the economist noted. What’s more, the Bureau of Labor Statistics has never been able to reconcile them and is currently using payroll jobs for its measurements.

One also has to take a look at those 156,000 jobs, Dr. Roberts continued. Just about one eighth of the jobs have anything to do with producing goods that could possibly be exported to balance the growing trade deficit.

Meanwhile, the lion’s share of jobs reside in retail trade, i.e. sales, health care and social assistance, leisure and hospitality (in other words, bartenders, waitresses, etc.).

“So, these are not the kind of jobs that show that you are a dynamic manufacturing industrial society,” the economist emphasized. “So, in fact, in the real manufacturing, there’s no growth in jobs. That’s not a very good idea of a healthy economy.”

A U.S. flag waves outside the New York Stock Exchange, Monday, Jan. 24, 2022, in New York. Stocks are drifting between small gains and losses in the early going on Wall Street Tuesday, May 3, 2022 as investors await Wednesday’s decision by the Federal Reserve on interest rates.

The Fed is expected to raise its benchmark rate by twice the usual amount this week as it steps up its fight against inflation, which is at a four-decade high. – Sputnik International, 1920, 17.03.2023

Money Supply Shrinking, Banks Growing Insolvent

At the same time, money supply growth has turned negative, the former Reagan official highlighted, adding that the last time this happened was the Great Depression. According to him, the unfolding situation is fraught with recession risk.

“What happened during the Great Depression, when there were runs on banks, the Federal Reserve did not meet its obligation as a lender of last resort to supply the reserves to the banks to keep them from failing,” Dr. Roberts explained. “And so, when a bank failed, the money supply would shrink by the amount of the bank’s deposits. Today, the money supply shrinks largely – I mean, it can still shrink for the same reason. For example, when a bank fails, it still shrinks the money supply. But the Fed, also the way it manages policy, can cause the money supply to shrink. And what it means is the amount of money in circulation no longer supports the amount of goods and services. So, when the money supply shrinks, either the prices of the goods and services have to shrink, or the supply of goods and services. And it seems it’s always the supply. So when the money supply shrinks, employment shrinks, and the economy declines.”

Another reason that the US is in trouble is the 12 years of low interest rate policy by the Federal Reserve, the economist continued. US banks have become reliant on low-rate instruments such as government bonds.

Still, a bond’s value is the inverse of the interest rate. When the Fed resorted to aggressive interest rate hikes last year, bonds and some other financial instruments went down.

All of these assets that are interest rate sensitive on the banks’ books are now below what they cost, but their liabilities haven’t declined. So these banks are technically insolvent, the economist said. This is what happened to the California-based Silicon Valley Bank, and what may happen to at least 200 other US banks, Dr. Roberts remarked, referring to a recent study published on the Social Science Research Network.

Moreover, even though big banks have claimed that they learned their lesson from the 2007-08 crisis, they actually have not: they are still using depositors’ money to speculate and to bail themselves out, according to the economist. The result is the public’s growing distrust in the banking system and subsequent capital withdrawal.

“The trouble is, depositors seeing that the banks are insolvent, they get disturbed and they start pulling their assets out,” the economist said. “Well, in order to meet the withdrawals, the banks have to sell the assets, but the assets have lost value, so they are taking losses on every sale. This wouldn’t work in terms of meeting all the withdrawals. Another reason people are withdrawing their assets is the banks are now paying practically no interest on deposits. But money market funds are paying 4.5%. So people are taking money out of the bank and putting it in money market funds. Well, according to reports, $1 trillion have been withdrawn from bank deposits. Well, this is a shrinkage of the banks’ ability to provide liquidity. So this is a serious situation. How far will this go? How reassuring will the Fed be that it will perform its function as a lender of last resort and prevent these banks from failing? I don’t know. You know, any sort of thing can trigger a serious situation, because the situation is serious. The banks are technically insolvent. So I don’t have a great deal of confidence in what the Treasury secretary said.”

These and other factors make recession in the US highly probable; if it comes, it’s unlikely to be mild, especially given that American consumers are heavily in debt, Dr. Roberts noted.

“Americans, most of them, are hand to mouth,” the economist said. “I mean, even people with high incomes are living hand to mouth. Because they spend it all, the mortgage to have a great big house, the mortgage on their house, the mortgage on their expensive cars, the private schools, whatever. So everyone is living on credit. So if you find unemployment rising, how do you meet your debts? How do you service your debts? And so I think the situation is somewhat serious and that a recession, if it happens, would probably be severe.”

Why De-Dollarization is Bad News for US

Under these circumstances, apparently the most unwise thing was to slap sweeping sanctions on Russia, freeze its Central Bank reserves, sever it from SWIFT, and impose restrictions on China’s industries.

According to the economist, the Biden administration’s policies became a wake-up call not only for Moscow and Beijing, but also for many other developing nations, who started to increasingly de-dollarize.

As a result, the demand for dollars in international transactions is falling, while Washington is running massive trade and budget deficits which have to be financed.

“[The US] could print money because the dollar was the world reserve currency and everyone used the dollar for its own international transactions,” the economist explained. “But if the dollar starts losing this role and fewer and fewer countries use it for international transactions, how’s the Fed going, or the government going to print dollars to pay its bills, if it’s not the reserve currency, is not in universal demand? So what happens if the dollar would – poof! – go down? That would mean a massive US inflation. It’d be a kind of inflation that results from currency collapse. There’s nothing monetary authorities can do about that. Those kinds of inflations are the real inflations, the real deadly ones.”

One might ask how long the greenback will survive and how quick the transition will be away from the dollar. Russia, China, and BRICS in general, are switching to settlements in national currencies. The trend is also spreading into South America and into Africa.

“So, it means the demise of the dollar as world reserve currency, which means the demise of American power, because American power is based on the ability to pay bills by printing money,” Dr. Roberts highlighted. “Nobody else can do that. And that’s dependent on the dollar as reserve currency. So what the sanctions did, really Washington shot itself in the head. Yeah, in the head, because it said, ‘Hey, you better get out of dollars because we use them as a punishment mechanism.'”

Time to Bring US Jobs Back Home Long Overdue

But that’s not all. Over the last 30 years, the US has relocated its manufacturing abroad. As a result, when these goods are brought back into the United States, they come in as “imports,” the economist continued.

So, the trade deficit goes up and has to be financed the way Washington has always financed it – by printing money. “But how’s the Fed going or the government going to print dollars to pay its bills, if it’s not the reserve currency, is not in universal demand?” the author asked.

To complicate matters further, the offshoring of jobs has decimated the American workforce after 30 years, according to Dr. Roberts:

“People don’t know how to do these jobs anymore. They don’t have the discipline to go work a manufacturing shift. The infrastructure in the cities is gone. Many of the American cities are ruins. People don’t realize this. I wrote about it in a book, The Failure of Laissez Faire Capitalism, the massive loss in populations of big cities – Detroit, Saint Louis – once the backbone of American manufacturing. So you have the demographic change, you have the infrastructure within the cities, you have the supply chains within the country – they’re all broken and gone. You’re facing the sort of situation India had 50 years ago as an undeveloped country, and you’re trying to restore development.”

Meanwhile, China is poised to have an edge on the US, because the Americans gave it a tremendous advantage by moving their manufacturing to Asia, according to the author. Eventually, the Chinese learned the techniques and the business organization, they got the technology.

What’s more, the Chinese banks lend for real investment in the economy, while the US banks don’t, Dr. Roberts pointed out.

“Where the American banks lend for the purchase of existing assets, mortgages, or they finance takeovers of existing companies, they engage in financial arbitrage and in debt leveraging,” the economist said. “They’re not doing anything that helps the real economy. They’re financing Wall Street’s gambling casinos. Well, when you have banks that don’t perform any useful social function – and the American banks don’t – and the Chinese banks are financing real investment, and 80% of the banks in China are socialized, how do you compete? You can’t.”

The only way for the US to get back on track is to overhaul the system and go back to a protected economy, the economist concluded.

By Ekaterina Bolinova

Published by Sputnik Globe

Republished by The 21st Century

The views expressed in this article are solely those of the author and do not necessarily reflect the opinions of 21cir.com