The economy could use a good dose of “aggregate demand”—new spending money in the pockets of consumers—but QE3 won’t do it. Neither will it trigger the dreaded hyperinflation. In fact, it won’t do much at all. There are better alternatives.

The Fed’s announcement on September 13, 2012, that it was embarking on a third round of quantitative easing has brought the “sound money” crew out in force, pumping out articles with frighting titles such as “QE3 Will Unleash’ Economic Horror’ On The Human Race.”

The Fed calls QE an asset swap, swapping Fed-created dollars for other assets on the banks’ balance sheets. But critics call it “reckless money printing” and say it will inevitably produce hyperinflation. Too much money will be chasing too few goods, forcing prices up and the value of the dollar down.

All this hyperventilating could have been avoided by taking a closer look at how QE works. The money created by the Fed will go straight into bank reserve accounts, and banks can’t lend their reserves. The money just sits there, drawing a bit of interest.

The Fed’s plan is to buy mortgage-backed securities (MBS) from the banks, but according to the Washington Post, this is not expected to be of much help to homeowners either.

Why QE3 Won’t Expand the Circulating Money Supply

In its third round of QE, the Fed says it will buy $40 billion in MBS every month for an indefinite period. To do this, it will essentially create money from nothing, paying for its purchases by crediting the reserve accounts of the banks from which it buys them.

The banks will get the dollars and the Fed will get the MBS. But the banks’ balance sheets will remain the same, and the circulating money supply will remain the same.

When the Fed engages in QE, it takes away something on the asset side of the bank’s balance sheet (government securities or mortgage-backed securities) and replaces it with electronically-generated dollars.

These dollars are held in the banks’ reserve accounts at the Fed. They are “excess reserves,” which cannot be spent or lent into the economy by the banks. They can only be lent to other banks that need reserves, or used to obtain other assets (new loans, bonds, etc.). As Australian economist Steve Keen explains:

[R]eserves are there for settlement of accounts between banks, and for the government’s interface with the private banking sector, but not for lending from. Banks themselves may . . . swap those assets for other forms of assets that are income-yielding, but they are not able to lend from them.

This was also explained by Prof. Scott Fullwiler, when he argued a year ago for another form of QE—the minting of some trillion dollar coins by the Treasury (he called it “QE3 Treasury Style”). He explained why the increase in reserve balances in QE is not inflationary:

Banks can’t “do” anything with all the extra reserve balances. Loans create deposits—reserve balances don’t finance lending or add any “fuel” to the economy.

Banks don’t lend reserve balances except in the federal funds market, and in that case the Fed always provides sufficient quantities to keep the federal funds rate at its . . . interest rate target. Widespread belief that reserve balances add “fuel” to bank lending is flawed, as I explained here over two years ago.

Since November 2008, when QE1 was first implemented, the monetary base (money created by the Fed and the government) has indeed gone up. But the circulating money supply, M2, has not increased any faster than in the previous decade, and loans have actually gone down.

Quantitative easing has had beneficial effects on the stock market, but these have been temporary and are evidently psychological: people THINK the money supply will inflate, providing more money to invest, inflating stock prices, so investors jump in and buy.

The psychological effect eventually wears off, requiring a new round of QE to keep the game going.

That is what happened with QE1 and QE2. They did not reduce unemployment, the alleged target; but they also did not drive up the overall price level. The rate of price inflation has actually beenlower after QE than before the program began.

Why, Then, Is the Fed Bothering to Engage in QE3?

If the Fed is doing no more than swapping bank assets, what is the point of this whole exercise? The Fed’s professed justification is that by buying mortgage-backed securities, it will lower interest rates for homeowners and other long-term buyers. As explained in Reuters:

Massive buying of any asset tends to push up the prices, and because of the way the bond market works, rising prices force yields [or interest rates] down. Because the Fed is buying mortgage-backed bonds, the purchases act to directly lower the cost of borrowing to buy a home.

In addition, some investors, put off by the rising price of the bonds that the Fed is buying, turn to other assets, like corporate bonds – which, in turn, pushes up corporate bond prices and lowers those yields, making it cheaper for companies to borrow – and spend.

Those are the professed objectives, but politics may also play a role. QE drives up the stock market in anticipation of an increase in the amount of money available to invest, a good political move before an election.

Commodities (oil, food and precious metals) also go up, since “hot money” floods into them. Again, this is evidently because investors EXPECT inflation to drive commodities up, and because lowered interest rates on other investments prompt investors to look elsewhere.

There is also evidence that commodities are going up because some major market players are colluding to manipulate the price, a criminal enterprise.

The Fed does bear some responsibility for the rise in commodity prices, since it has created an expectation of inflation with QE, and it has kept interest rates low. But the price rise has not been from flooding the economy with money.

If dollars were flooding economy, housing and wages (the largest components of the price level) would have shot up as well. But they have remained low, and overall price increases have remained within the Fed’s 2% target range. (See chart above.)

Some Possibilities That Might Be More Effective at Stimulating the Economy

An injection of money into the pockets of consumers would actually be good for the economy, but QE3 won’t do it. The Fed could give production and employment a bigger boost by using its lender-of-last-resort status in more direct ways than the current version of QE.

It could make the very-low-interest loans given to banks available to state and municipal governments, or to students, or to homeowners. It could rip up the $1.7 trillion in government securities that it already holds, lowering the national debt by that amount (as suggested a year ago by Ron Paul).

Or it could buy up a trillion dollars’ worth of securitized student debt and rip those securities up. These moves might require some tweaking of the Federal Reserve Act, but Congress has done it before to serve the banks.

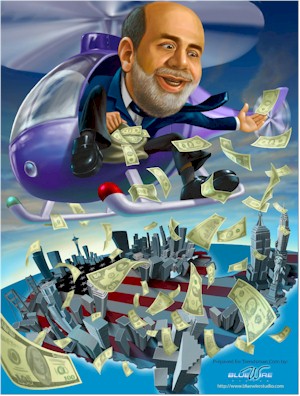

Another possibility would be the sort of “quantitative easing” first proposed by Ben Bernanke in 2002, before he was chairman of the Fed—just drop hundred dollar bills from helicopters. (This is roughly similar to the Social Credit solution proposed by C. H. Douglas in the 1920s.) As Martin Hutchinson observed in Money Morning:

With a U.S. population of 310 million, $31 billion per month, dropped from helicopters, would have given every American man, woman and child an extra crisp new $100 bill per month.

Yes, it would produce an extra $31 billion per month on the nominal Federal budget deficit, but the Fed would have printed the new bills, so there would have been no additional strain on the nation’s finances.

It would be much better than a new social program, because there would have been no bureaucracy involved, just bill printing and helicopter fuel.

The money would nearly all have been spent, increasing consumption by perhaps $300 billion annually, creating perhaps 3 million jobs, and reducing unemployment by almost 2%.

None of these moves would drive the economy into hyperinflation. According to the Fed’s figures, as of July 2010, the money supply was actually $4 trillion LESS than it was in 2008.

That means that as of that date, $4 trillion more needed to be pumped into the money supply just to get the economy back to where it was before the banking crisis hit.

As the psychological boost from QE3 wears off and the “fiscal cliff” looms, perhaps Congress and the Fed will consider some of these more direct approaches to relieving the economy’s intractable doldrums.

Ellen Brown is an attorney and president of the Public Banking Institute. In Web of Debt, her latest of eleven books, she shows how a private cartel has usurped the power to create money from the people themselves, and how we the people can get it back. Her websites are http://WebofDebt.com, http://EllenBrown.com, and http://PublicBankingInstitute.org.

Global Research