If most Americans had to choose between saving and spending, they would decide to join the spending team. Americans are so drawn to spending that they will even purchase items theycannot afford. Another recent survey found that 40 percent of Americans have less than $500 saved. This aligns with a survey we found last year stating one out of every three Americanshas nearly no savings. How is it possible that in the most prosperous nation in the world that we have an addiction to spending but also financing this spending through incredibly high levels of debt? We are reaching a level of peak debt for our nation and it is understandable that we cannot continue on this path. Of course platitudes and lip service abound but a national debt of over $16 trillion reflects a nation willing to go into massive debt to keep the dance going for a few more hours.

Financing a generation on debt

One of the more telling charts is looking at household debt versus the actual personal savings rate:

From 1950 to the early 1980s, Americans were saving roughly 10 percent of their income. Keep in mind this also occurred during a period where companies offered generous retirement plans and pensions. However, starting in the 1980s Americans started spending more of what they earned and financing much of their consumption. You can see this by looking at the blue line above. The party must have seemed like it would never end. Household debt went from the $1 trillion range in the 1970s all the way up to over $14 trillion at our recent peak.

Financing this misadventure must have appeared like a good idea to many. Buying houses people couldn’t afford and financing cars that many clearly could not sustain. As a nation we are hyper-consumers. This generation long obsession is reflected in how our government spends. We want it all but really don’t want to pay for it. The bill came due in the 2000s and this is why we now find our nation moving backwards and many households are struggling to get by. The major difference this time is that households have taken their austerity pill while the connected banks have taken on trillions of dollars of bailouts and continue to make money by socializing their defeats and privatizing their ill-gotten gains.

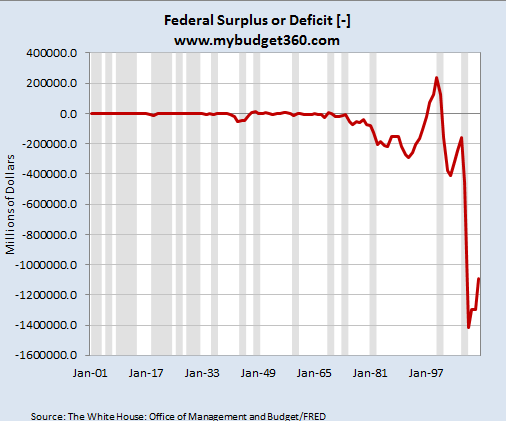

We are running incredible deficits:

This is a generational pattern here since this started in the 1970s. The reason the US is able to do this is the gains that have occurred over time. The foundation is strong but is getting eroded. You can gamble more after being hot for many years. Many Americans are now seeing the hidden costs to all of this in the form of household incomes going back to 1995 levels, 46 million Americans on food stamps, and the rising cost of many items. In other words the bill is coming due.

There is a false sense of prosperity that comes from confusing access to debt with actual wealth. No, the real wealth in this country is largely aggregated in a few hands. These surveys showing that Americans barely have enough to get by with one missed paycheck show a deeper issue at hand. Many are being pushed into a low wage capitalism system. Spending this much via banking bailouts, gifts to the too big to fail banks, and the Fed making it cheaper for people to borrow simply pushes the bill out further into the future.

Spending money you do not have is not a wise financial decision. If you pause for a second and think about it there is logic behind this. Yet voodoo finance and other nonsense has convinced many in the public to be like zombie hamsters and continue spending even if they are unable to support this with their declining disposable income. The media for the most part is like a Valium pill keeping people calm enough with their reality TV and iPhones to stay occupied. Otherwise people would realize that something is awry when half your country is nearly broke.

one of our visitors just lately suggested the following website