Donald Trump has threatened to slap BRICS members with 100% import duties if the bloc tries to create its own monetary unit or backs “any other currency to replace the mighty dollar.” How could this look in practice? And who would stand to lose more if the president-elect made good on the threat? Sputnik asked a renowned British economist.

“The idea that the BRICS Countries are trying to move away from the Dollar while we stand by and watch is OVER,” Donald Trump wrote in a social media post Saturday outlining his plans to reestablish US global economic primacy after stepping into office next month.

“We require a commitment from these Countries that they will neither create a new BRICS Currency, nor back any other Currency to replace the mighty US Dollar, or they will face 100% Tariffs, and should expect to say goodbye to selling into the wonderful US Economy. They can go find another ‘sucker!’ There is no chance that the BRICS will replace the US Dollar in International Trade, and any Country that tries should wave goodbye to America,” Trump warned.

Expressing a penchant for steep tariffs targeting allies and adversaries alike during his first term in office, and hinting at plans to repeat his old policy by tapping his former trade czar Robert Lighthizer to return to the job come January, Trump’s threat of “100% Tariffs” against the BRICS is his most sweeping trade-related intimidating remark yet, targeting an economic bloc that accounts for some 35% of global economic activity in PPP terms, and over 40% of the planet’s population.

The US is heavily dependent on the BRICS economically, and President-Elect Trump has got another thing coming if he thinks he can threaten and cajole the bloc into submission, veteran British economist and Global Justice Movement co-founder Rodney Shakespeare told Sputnik.

“Trump thinks he can target BRICS countries individually but doing this will cause BRICS to act collectively in response and then the situation is about who has the bigger overall trade, population and resources. Trump’s thinking is fundamentally based upon a situation of past hegemony whose time is rapidly passing,” Shakespeare, who now teaches as a visiting scholar at Indonesia’s Trisakti University, explained.

A statue of former Treasury Secretary Albert Gallatin stands outside the Treasury Building in Washington. – Sputnik International, 1920, 24.11.2024

A statue of former Treasury Secretary Albert Gallatin stands outside the Treasury Building in Washington. – Sputnik International, 1920, 24.11.2024

US National Debt Surpasses $36 Trillion, Setting New Record High

24 November, 06:50 GMT

How Would US-BRICS Trade War Look?

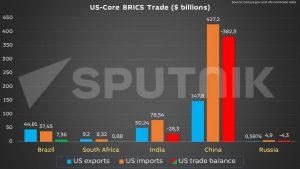

The United States has a trade deficit of nearly $433.5 bln with BRICS member countries. None of the BRICS partner countries and candidates for membership (over 50 countries total) have major trade deficits with the US, while several boast major surpluses. Potential partner Vietnam alone had a surplus topping $109 bln in 2023.

Chart showing US trade surplus and deficit with core BRICS countries. – Sputnik International, 1920, 01.12.2024

Chart showing US trade surplus and deficit with core BRICS countries. © Sputnik

Chart showing US trade surplus and deficit with core BRICS countries. © Sputnik

The US relies on BRICS for a broad array of physical products, from household goods, machinery and electrical gear to pharmaceuticals and medical equipment, energy, chemicals and rare earth minerals, with bloc accounting for between 40%-70% of the production of these goods and materials. By comparison, the US’s main physical exports (arms, petroleum, food and automobiles) are plentiful in the world economy, especially among BRICS members.

Services and intellectual property – which accounted for $1.1 trln in US exports in 2023 and included things like franchising, design, management, consulting, financial and advisory services, patents, trademarks, software and art, are ethereal goods which the BRICS bloc could gradually replace with domestic alternatives if the US were to suddenly disappear from the global market for any reason – in the event of a major trade war involving someone leveling 100% tariffs, for example.

US trade balance with new BRICS members. – Sputnik International, 1920, 01.12.2024 © Sputnik

US trade balance with new BRICS members. – Sputnik International, 1920, 01.12.2024 © Sputnik

As the de facto world reserve currency, the dollar itself has long been a major American export, with foreign countries owning some $7.6 trln in US Treasuries, and dollars accounting for some 54% of global trade (although in BRICS-to-BRICS trade 65% of trade is now settled in local currencies).

All this means that if Trump greenlights the 100% tariffs on the BRICS bloc, “there would be huge increases on [the price of] American-imported consumer products,” Dr. Shakespeare said.

“Trump hopes that American industry would then revive sufficiently to produce the same products at cheaper cost. That could happen except that the new factories will NOT produce large numbers of jobs (they will be near-automated).”

Ultimately, “since economic power is shifting away from the US,” if the US goes ahead with major trade war, against either BRICS countries collectively or even major bloc members individually, “it could be a war which the US will lose,” the veteran economist warned.

If Trump made good on his threats, this would accelerate dedollarization, speed up global efforts to reduce dependence on key US exports, and quickly bring a nation that has spent decades exchanging green pieces of paper for real, physical goods to the brink of economic ruin.

Downhill Since Bretton Woods: ‘Unipolar US Dollar’ Mutated Into ‘Politically Weaponized’ Tool

1 July, 10:26 GMT

By Ilya Tsukanov

Published by Sputnik Globe

Republished by The 21st Century

The views expressed in this article are solely those of the author and do not necessarily reflect the opinions of 21cir.com